The present column reveals current balances which would possibly be zero – 30 days old (aka not past due). Justin Campbell, an experienced accountant with a decade at Xero, blends his deep understanding of finance and know-how to simplify processes. He makes use of his expertise to help businesses work smarter, bringing precision and innovation to every initiative. Each reports use the identical construction however give consideration to different components of your money move. This means your getting older report is always accurate, updated and actionable – with out the guide upkeep. Creating an getting older report is straightforward but utilizing it successfully can make all the distinction.

Again, when you use software, this could automatically be done for you if you document a fee https://www.simple-accounting.org/ made to your vendor. Aging schedules are sometimes used by managers and analysts to assess a business’s operational and financial efficiency. With the advanced capabilities of Livecube, users can easily slice and cube the info to achieve deeper insights, serving to to manage money circulate extra successfully and reduce late cost risks. These professionals use the report again to finances, forecast cash flows, and make strategic financial selections. By understanding when funds are due, they’ll higher handle the corporate’s money reserves and plan for future monetary needs. For occasion, invoices in the “over ninety days” category are often critical.

Accounts Payable Aging Report: Definition And Examples

- Getting Older schedules are a critical part in the management of an organization’s funds, particularly in relation to understanding the liquidity and well being of accounts receivable and payable.

- Simply addContent your type sixteen, declare your deductions and get your acknowledgment quantity on-line.

- To fight fraud assaults, strong inside controls in accounts payable are necessary.

- However, an extended or shorter DPO can have a huge effect on the enterprise, including provider relationships or money flow.

If you’re creating the report manually, calculate the total amount owed for a clear understanding of outstanding liabilities and help with money circulate forecasting. It categorizes excellent invoices by the number of days they’ve been unpaid, giving a transparent picture of a business’s liabilities. Software Program options can automate invoice categorization, report technology, and even cost reminders. This frees up your group to focus on more strategic actions, like analyzing developments and constructing customer relationships. Schedule a demo with HubiFi to see how our automated solutions can save you time.

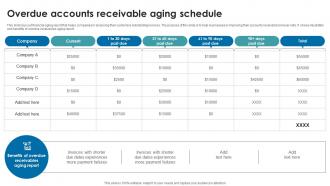

An accounts receivable (AR) ageing report is the alternative of an ageing accounts payable report—one shows the shopper invoice, while the other shows the seller invoice. Vendor invoices (vendor bills) are digital (or paper) paperwork with credit fee phrases requesting fee for items shipped or providers provided by the supplier to a buyer. An instance of an Accounts Payable Aging Report Abstract is shown as of month-end.

Company Overview

By understanding the proportion of receivables that may be uncollectible, the business can look for solutions to their cash-flow issue earlier than the problem spirals out of control. For sure industries, corresponding to retail or manufacturing, growing older schedules can play a major half in setting credit requirements. If a company notices it has a consistent problem with a lot of delinquent accounts, it might have a glance at elevating its requirements in relation to a customer’s credit score rating. This detailed breakdown helps companies handle their payables effectively. It ensures they are conscious of all outstanding liabilities and can plan their money circulate accordingly. It consolidates the entire quantities owed to each vendor, providing a high-level overview with out the granularity of the bill details.

It permits a clear visualization of how long payables have been excellent, which helps prioritize vendor funds. This process is essential for maintaining a healthy cash flow and guaranteeing that all outstanding invoices are appropriately managed. The accounts payable getting older report permits companies to maintain optimistic relationships with their suppliers and vendors. AP aging stories may be managed and prepared in real time with ClearTech’s Stories.

The AR growing older report reveals amounts for buyer invoices billed with credit score terms however not but collected. Use your AP getting older report to spot which invoices are overdue and deal with them first. If plenty of invoices are sitting within the 60+ or 90+ day columns, it may imply there are points together with your inside processes. This may embody delays in approval, missing data or even money circulate issues. The Accounts Receivable Growing Older Report details quantities owed to the enterprise by its customers, providing insight into incoming money flows. In distinction, the Accounts Payable Getting Older Report focuses on what the business owes to its vendors, detailing outgoing cash flows.

This proactive approach can considerably scale back the number of invoices that turn out to be dangerous debt, bettering your general cash circulate. The distinction between the aged payables report vs. accounts receivable aging report is vendor invoice vs customer invoice. The AP getting older report displays the whole of unpaid bill balances due by vendor and present amounts or the number of days overdue in 30-day ranges.

It Is a proactive measure to prevent cash move disruptions and to maintain a strong working capital position. For an auditor, it serves as a verification tool to evaluate the collectability of receivables and the adequacy of the allowance for uncertain accounts. In The Meantime, from a credit score manager’s viewpoint, the growing older schedule is a strategic asset in evaluating credit score policies and buyer creditworthiness. The schedule can additionally be used to assist handle and improve your corporation’s cashflow, especially when projectingyour money outflows for a cashflow finances.

Conversely, a well-maintained getting older schedule with minimal overdue payments suggests robust credit control measures are in place. A detailed AP growing older report shows invoices with reference quantity, due date, fee phrases, and steadiness due. The opposite of accounts payable aging report is the accounts receivable report, which outlines when a business can expect payment from its customers. It additionally serves as an early warning system for potential cash circulate problems, enabling enterprises to deal with monetary points proactively. The purpose of the accounts payable getting older report is to permit companies to trace and handle their excellent funds extra efficiently.

Accounts payable growing older schedule exhibits you the listing of all suppliers with the payback interval. Additionally, the growing older schedule highlights late funds to keep away from late payment charges by distributors. When groups use the AP getting older report, they’ll make strategic selections on when to pay invoices. Nonetheless, they can also see upcoming bills, giving them more data on how future funds and AP may have an result on their cash circulate.